Barry Scheer

+31(0)88 253 1143 | bscheer@alfa.nl

19th of June 2019 | Door: Barry Scheer

According to Dutch tax law, employers have the possibility to reimburse expenses to employees free of tax, or under a reduced tax rate.

Per 2020 the possibilities even gets better, as published in the plans of Dutch government.

Within the WKR-scheme an employer can effectively give his employees extras by maximizing her possibilities of these tax free remunerations. However, the employer must comply with sufficient administration in connection with the burden of proof. Furthermore, it is advisable to administrate sufficiently during the calendar year, so the employer will not be surprised with additional tax at the end of the year.

Real time remunerations to an employee, based on real costs, are most of the time tax free, e.g. travel expenses, as long as it is limited within its conditions prescribed by law. By law the possibilities of tax free remunerations are specified, the conditions. For tax free remunerations, employers need to proof that these situations meet the conditions.

Some remunerations are not tax free, e.g. employees’ statement of conduct (2019). And all remunerations that an employer can or will not proof what it is exactly or meeting the conditions of it. For this category Dutch tax law has made a gesture (from 2011): The WKR-scheme. To that effect, some reimbursements are suitable for tax in the first place, but every employer gets a tax free sum per calendar year regarding these circumstances. As long as the sum of these remunerations will not exceed the tax free sum per calendar year, still no Dutch wage tax is payable. If the sum of taxable remunerations exceeds the tax free sum, the Dutch tax authorities will impose a final levy of 80% straight from the employer.

For example

An employer has a sum of compensations and remunerations of E 30.000,- and has administrated these elements under the WKR-scheme. These amounts need to be calculated including VAT. Based on administration, E 10.000,- of it proofs to be tax free circumstances and meets the conditions of Dutch tax law. Before the other E 20.000,- will be taxed, the tax free sum can be deducted. If in this example the tax free sum is E 19.000,-, the employer exceeds the sum of remunerations for E 1.000,-. The employer is obliged to pay E 800,- tax (ultimately in February of the following year – by declaring it in the wage tax return).

What we learn from this example is that the payments of in total E 20.000,- are not meeting tax free conditions, are not administrated for further proof – only appointed to the scheme – and still the employer only pays E 800,- tax.

This is why it is very important to designate the elements to the WKR-scheme, to administrate the sum of it, to sort tax free or taxable remunerations, to calculate the tax free sum, and possibly declare to Tax Authorization in the end of the year. There is too little information by just an invoice in bookkeeping to sort and/or designate the elements in the right way. So this is why Dutch payroll services are always asking for these elements.

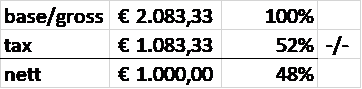

Even if an employer needs to pay E 800,- tax over E 1.000,- nett payments to employees (in example above), this is still beneficial. Because in normal wage tax calculations the taxability (and/or contributions social security) is more: If by example employee has the 52% tax rate, then normally the nett of it is just 48%. So, if E 1.000,- is 48% (nett), then the normal taxability would be 52% over a gross – that should be E 1.083,33.

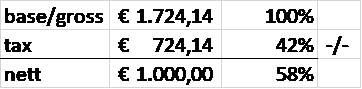

If an employee is normally taxed by 42% over a gross, the nett is equal to 58%. The example will now be calculated as:

But in this case it is assumable that the maximum contribution range for social securities is not met yet, that is why approximately 20% of E 1.724,14 = E 344,80 must be payed additionally, in total still more than the WKR scheme: E 1.068,94.

To prevent employers from abusing this scheme an extra rule is applicable: If the sum of designated WKR elements per employee per year is more than E 2.400,-, the tax authorities will determine whether this has been customary. If it is not customary and deviated more than 30%, it is not allowed to designate the elements to the WKR scheme. Up to this ‘boundary’ it is possible to maximize the benefits of the WKR-scheme without questions of the tax authorities. Extra advise: It is possible to transfer tax free sums between administrations if companies are situated in a group company structure.