Matthijs van Dorssen

Director International

+31(0)88 253 3208 | mvandorssen@alfa.nl

7 oktober 2022 | Door: Matthijs van Dorssen

What important tax proposals did the Minister of Finance pull out of his briefcase on Prince’s Day? An explanation of the ten most important proposals is provided below.

The minimum wage will be raised with more than 10 percent at once from 2023 on. Because the national old age pension and the social assistance benefit are linked to the minimum wage, they will also accordingly be raised.

The tax rate of the first band is being lowered slightly: from 37.07 percent in 2022 to 36.93 percent in 2023. The first band is also being widened to 73,071 euro (69,398 euro in 2022).

The employed persons tax credit is being raised from January 1st 2023 with the aim of providing purchasing power. Employees (also the directors/major shareholders) and also entrepreneurs for the personal income taxes will profit from this measure. With a higher income this benefit will change in a disadvantage because of other measures.

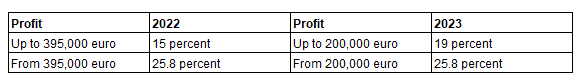

[Afbeelding met tafel Automatisch gegenereerde beschrijving] The corporation tax rates are rising and the tax bands are being narrowed. From January 1sty 2023 the tax rate for the first 200,000 euro of profit will be 19% and for the profit above 25.8%. Because of this change more profits will be taxed at the high rate of 25.8%. The tax income of this change will be used for financing the measures for providing purchasing power.

These changes can be a good reason to check whether a fiscal unity is still useful or should be terminated.

When you own 5 percent or more of the shares in a company, you’re considered a substantial shareholder. The benefits from these shares, such as paid out dividends are taxed in box 2 of the personal income taxes. The current tax rate for box 2 is 26.9 percent.

The plan is to introduce two tax bands from January 1st 2024, 24.5 percent on the first 67,000 euro and 31% on the excess amount. Together with the changes for box 3 of the personal income taxes the proposed changes are a good reason to look to the dividend policy of the company.

As a director/major shareholder (holding 5% or more of the shares in the company you’re working for) you have the obligation to pay yourself a customary salary. This salary is the highest of the three legal options, 48,000 euro, an equal salary to the highest salary received by an employee of the company, but at least 75% of the salary for the most comparable position (the efficiency margin).

The efficiency margin is being abolished from 2023. The customary salary will be the salary of the most comparable position at a minimum. This will mean that you might need to award yourself a higher salary. Paying yourself a salary from your own company is the most expensive option to get money from a company to yourself in private. This measure will therefore be disadvantageous from a tax perspective.

The tax rate for box 3 of the personal income taxes will be raised step by step. For 2023 the tax rate will be 32 percent (31 percent in 2022). In 2024 and 2025 the tax rate will be increased with 1 percent per year to 33 percent in 2024 and 34 percent in 2025.

The tax free allowance will also be raised to 57,000 in 2023 (50,650 in 2022).

Following the Supreme Court’s ‘Christmas judgement’ and the reparations due as a result the tax base for box 3 will be adjusted. The basis will be the actual distribution of your assets between three asset groups.

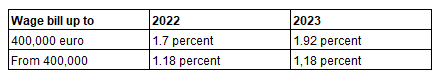

[Afbeelding met tafel Automatisch gegenereerde beschrijving] The work-related expenses scheme allows you as an employer to grant all kinds of allowances and benefits to your employees free of tax. The fixed budget under the work-related expenses scheme will be increased in 2023:

The fixed budget will be increased with 880 euro on a wage bill of exactly € 400,000. If you excess the fixed budget, you have to pay 80 percent taxes through the final levy in your payroll administration.

The transfer tax rate for property that is not considered as a residential property for the buyer’s own use will be raised to 10.4 percent in 2023 (8 percent in 2022). Because of this change companies and investors will have to pay a higher transfer tax when they buy real estate. The tax rate for residential properties for the buyer’s own use will remain at 2 percent and also the tax exemption for first-time buyers will remain.

Residential properties are valued against the WOZ value in box 3 of the personal income taxes. If the property is let to private individuals with the security of tenure the value can be reduced (vacant value ratio). From 2023 the vacant value ratio will be increased by updating the tables. This means that the value of the let property will be higher for taxation in box 3 and more tax has to be paid. The adjustment of the tables will also be adjusted in the Inheritance Tax.

In addition, two further changes will be made:

1. Temporary tenancy agreements will be excluded from the application of the vacant value ratio from 2023..

2. If the property is let to a related person (such as son or daughter) the vacant value ratio can’t be applied from 2023.

Please note! The vacant value ratio can’t be applied to holiday homes or non-residential properties.

For households the Government announced a maximum price for gas and electricity up to a specific usage. In addition Minister Adriaansens of Economic Affairs and Climate also announced that a supporting package will be announced for entrepreneurs in November. What this package will include is still unclear.