Matthijs van Dorssen

Director International

+31(0)88 253 3208 | mvandorssen@alfa.nl

9 november 2022 | Door: Matthijs van Dorssen

Which tax-related measures can you still benefit from this year as an entrepreneur? How can you respond smartly now to changes that will apply from 2023? Here are ten practical tips.

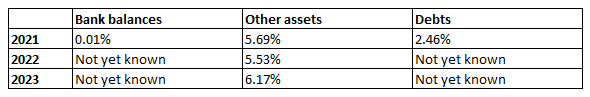

The tax on assets, also known as the box 3 tax, has been the subject of much discussion recently. From 2026 tax will have to be levied on actual returns. Until that time, from 2023 onwards income will still be determined on the basis of imputed returns.

The adjustment from 2023 is based on the so called ’savings variant’. This means that the actual composition of a person’s assets will be taken as a basis, divided between three different categories:

Each category has its own imputed return based on which the box 3 income will be calculated.

The tax rate for the income in box 3 is 32%.

Tip: the savings variant gives you the opportunity to look to the composition of your assets in box 3. It can be profitable to shut down a Savings BV. It’s also possible to transfer assets with a low rate of return to a BV or an open mutual fund.

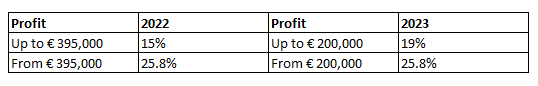

The tax rates for the Corporate Income Tax will increase and the first band will be narrowed. From 2023 the tax rate for the first € 200,000 of profit will be 19% and the tax rate for the profit above will be 25.8%. This means that profits will be taxed against the high rate sooner.

These developments can be a reason to:

The financial advantageous Business Succession Regulations for the gift- and inheritance tax en box 2 of the personal income tax have been subject to discussion for many years already. The regulations will be adjusted because of improper use of the tax credits. It’s already announced that rented property will not be subject to these regulations anymore. If you rent out property it’s good to get an advice on the possibilities and take measures.

In other cases it’s also recommendable to be flexible and already take measures to be able to act quickly if the government will decrease the tax credits. In November 2022 the government will decide on exact measures and adjustments in these Regulations.

This year the fixed budget under the work-related expenses scheme amounts to 1.7% up to a wage bill of € 400,000 and 1.18% on the excess amount. You should therefore make use of the fixed budget this year, as any unused portion cannot be carried forward to 2023.

If the fixed budget is not sufficient enough you will have to pay 80% tax. You should consider whether these expenses can be moved to 2023. In 2023 the fixed budget will be 3% up to a wage bill of € 400,000.

The director major shareholder can also make use of the fixed budget under specific conditions. This could be combined with the concern regulation. Please note that there might be a potential restriction on bonuses if you made use covid relief measures (NOW).

The transfer tax rate will increase from 8% to 10.4% in 2023.

In 2021 the general rate of the transfer tax already increased from 6% to 8%. From 2023 on the general rate will be increased further to 10.4%. Companies and investors will pay more transfer tax on buying properties.

The low rate of 2 percent and the so called tax exemption for first-time buyers will remain the same for residential property for the buyer’s own use.

If you’re planning to buy property as a company or investor there is a benefit of 25% if the notarial deed of the transfer will be before January 1st 2023, because the tax rate of 8% can be applied.

The tax exemption for gifts to assist with the purchase of an own home will be canceled completely from 2024 on. In 2023 the tax exemption will be reduced to almost € 29,000. The current tax exemption is more than € 106,000.

This one-time tax exemption can be applied if the recipient or his or her partner is between 18 and 40 years old and uses the gift to:

- purchase an own home or reconstruct their own home.

- pay back the mortgage on their own home or remaining debt from a former own home.

- buy out the ground rent, right of superficies or perpetual hereditary lease relating to their own home.

Please note!

For this tax exemption it was possible to spread out the gift over a period of three years. Under the current proposed adjustments a partial gift under the tax exemption done in 2022 can only be supplemented in 2023 and not anymore in 2024. If the gift under the tax exemption is done in 2023 there is no possibility to spread out the gift over different years.

Tip!

If someone receives a supplementary gift in 2022 or 2023, they still have time to spent this gift on their own home until 2024.

Tip!

If you don’t have the money now, but you will have it next year to gift the money under the tax exemption? By gifting a higher amount than the yearly exemption in 2022, you still have the possibility to supplement the gift to the amount of the tax exemption for an own home in 2023 under specific conditions.

If you’re a fiscal partner with a low income or no income, you might lose the general tax credits. You can prevent this loss by creating income in box 2 for example with a dividend payment and attribute this partly to the partner with the lowest income. Another possibility is to attribute box 3 income to the partner with the lowest income to make use of the tax credits.

Gifts to public benefit organizations (ANBI) paid by bank transfer are deductible under specific conditions. There are various choices to make for the deduction of gifts:

- regular gifts with certain deduction thresholds. Gifts can be combined in 2022 instead of paying gifts in 2023.

- periodic gifts that have no deduction threshold, but must be laid down in writing for a period of multiple years.

- gifts paid by your BV up to 50% of the profit with a maximum of € 100,000.

It can be interesting to calculate which option will result in the highest deduction and is the best fit for your situation.

Please be aware that due to a limitation of the maximum deduction in the Personal Income Tax the gift deduction becomes less profitable. Make sure to put deductible gifts forward as much as possible. In 2022 a gift has a maximum tax benefit of 40% and this will become 37% in 2023. Combining regular gifts in 2022 can be extra advantageous from a tax perspective.

As a director/major shareholder (DGA), you are obliged to award yourself a customary salary each year, which is taxed in box 1. The minimum salary is the highest of three legal options, 48,000 euro, an equal salary to the highest salary received by an employee of the company, but at least 75% of the salary for the most comparable position (the efficiency margin).

The efficiency margin is being abolished from 2023. The customary salary will be the salary of the most comparable position at a minimum. This will mean that you might need to award yourself a higher salary. Paying yourself a salary from your own company is the most expensive option to get money from a company to yourself in private. This measure will therefore be disadvantageous from a tax perspective.

Please note!

Make sure to have good proof for the level of your salary to prevent discussions on this topic with the Tax authorities.

If you invest more than € 2,400 this year, you may be entitled to the small-scale investment tax credit (KIA). This is an additional deduction from your profits. The amount of the deduction decreases the more you invest, starting from an amount of € 110,999. If your investments exceed this amount, you should therefore consider postponing investments at the end of this year if you would then receive a higher KIA in 2022 and 2023.

If you are also entitled to the energy investment deduction (EIA) or environmental investment deduction (MIA) for the investment in question, think about whether it makes sense to postpone the investment. Which investments will be eligible for the EIA and MIA in 2023 will not become clear until the end of 2022. If an investment is not eligible for the EIA and MIA in 2023, it’s better to invest in 2022.

For a BV it can be advantageous to postpone the investment to 2023. When the investment is still eligible for the EIA or the MIA, this may result in a higher deduction in 2023. Your investment may no longer be eligible in 2023, but it is also possible that in 2023 the EIA and/or MIA will result in a higher deduction. The increase of the tax rate but also the narrowing of the first band can lead to a higher tax advantage of the EIA and MIA.

Please note!

Some of these tips relate to proposals in the 2023 Tax Plan that still have to be approved by the Lower and Upper House. The government also frequently announces new plans or revises its plans. It is therefore important to always contact your Alfa advisor to discuss the situation.