Transition from one entity to another? Personnel in this entity? Watch out!

September 25th

It is rather common: Between entities a lot of actions can take place. An entity buys another. Or after setting up a new entity (in even another country) and then transferring some of all activities. Or just two existing entities working together in a project for a certain term. If personnel is connected in any way with this kind of transitions, there are some things you’ll rather consider.

Consequences in obligations to Dutch tax authority

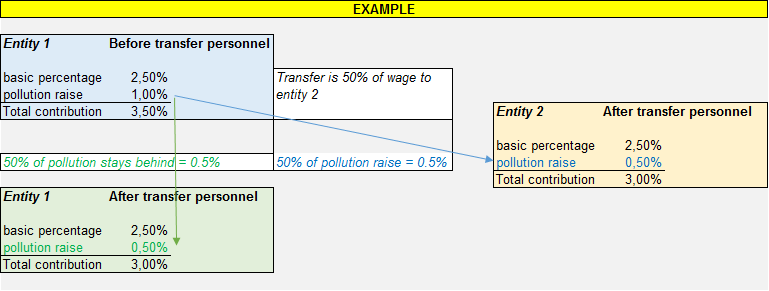

To start with, when an entity starts using personnel, mandatory procedures regarding the Dutch wage tax law should start as soon as possible. The entity should inform Dutch tax authorization of its personnel, by registering for wage tax declarations and contributions regarding social security and health care. This may be nothing new so far, but did you know that some of the contributions of social security will deviate from other entities, once personnel was ‘transferred’ from another entity if it can be concluded that there is a transition of business? This is also known as a transition of employment. Some contributions depend on ‘the pollution’. That means that an employer will be punished to contribute more in that part of social security, once one of his employees applies for payments. That is why a new entity is mandatory to also inform Dutch tax authorization that personnel is transferred (in percentage of the total from the leaving entity). Of course, the leaving entity will get an adjustment in contribution also.

Consequences in labor law

Secondly, in Dutch Labor law there is possibility that employers have to pay dismissal fee by terminating the contract. This also applies if a labor agreement just ends on the fixed term, if employee was employed for 2 years or more. Furthermore, employers in The Netherlands are able to apply fixed term contracts for a cumulative period of two years. Any longer will result in contract for unlimited time. In case of transferring personnel from one to another entity, the employee can claim successfully that the term of employment during employer one must be cumulated with the term of employment during employer two. The result in many cases will be that the latest employer is obliged to (a) possible a contract for unlimited time and/or (b) pay the dismissal fee. The amount of this dismissal fee, called the ‘Transition fee’, is based on the history of half employment years.

For example: If employee was employed by Entity one for eleven years, and was transferred to Entity two. One year later Entity two discharges this employee, so the fee is obliged (twelve years of employment) and the amount should be calculated to ‘roughly’ four monthly salaries.

In the field we experience that employers are not familiar with this procedure. And this was just one example of the prevalent situations that the employer next in line can have severe consequences. Sometimes, employers do not even realize that they are the next in line with ‘cumulative employment consequences from the past’! Because this kind of law is already applicable when in many cases just some activities were transferred between two entities.

Consequences in subsidies

The third item that employers should be aware of is that several subsidies are related to terms of employment. The applicable discount on employees with a state of labor disability, can be € 7.000 a year (at this moment) for three years in a row. Now Entity one has ended this employment, that leads to ending the discount. But if Entity two uses the transfer-rule, then Entity 2 can continue the term of three years. Sometimes a problem can occur that expected subsidies completely disappear when a transfer is executed during a calendar year. For example, the subsidies for low wages has to meet the term that an employee has a minimum of 1248 payed hours in a calendar year. An employer that transfers his personnel administration (registration Dutch tax authorization) to another entity on July 1st, then it’s likely that this calendar year in both of this entities regarding the transferred personnel no subsidy is applicable.

For example: if 15 fulltime employees should transfer on July 1st, a possible subsidy of € 30.000 will be lost in this year. So it can be very advisable to schedule a transfer in a smart way!

Concluding

Just a random selection of consequences based on several points of view, the conclusion is clear: Before transferring activities or business related to personnel, please investigate the consequences carefully.